McClendon: Don't Fear The Raider

Most of us pay little attention to stock transactions, but when the person buying the stock is corporate raider Carl Icahn, and the company he's buying stock in -- Chesapeake Energy -- is one of your top employers, we need to not only pay attention, but ask questions.Thursday, February 24th 2011, 3:58 pm

Alex Cameron, Oklahoma Impact Team

OKLAHOMA CITY -- Stock transactions aren't typically front page news in this city. Maybe this one should have been.

In December, Carl Icahn, the New York City billionaire and private equity investor, acquired a very significant number of shares of Chesapeake Energy stock. Icahn increased his total number of Chesapeake Shares to 38.6 million, giving him 5.8 percent of Chesapeake's outstanding stock, and making him the company's second largest shareholder. Southeastern Asset Management is number one, with a 12 percent stake.

Icahn's reputation as a corporate raider, on its own, would have be enough to grab the attention of other Chesapeake shareholders, Chesapeake employees, and anyone who cares about the future of the company. But, in Oklahoma City, Icahn has more than a reputation -- he has a history. And, coincidentally, that history is with another local oil and gas company.

In 2005, Icahn purchased an even larger stake in Oklahoma City-based Kerr-McGee, and quickly adopted an adversarial position with company management. Icahn argued the stock was undervalued because Kerr-McGee was over-extended.

Icahn and his partners eventually reached a truce with the company, but not before executives agreed to sell off Kerr-McGee's chemicals business and buy back $4 billion in stock. A year later, Kerr-McGee was purchased by Houston-based Anadarko Petroleum, resulting in the loss of an Oklahoma City institution, not to mention about 200 corporate jobs.

"In my view, that was driven by events not related to Carl [Icahn]," said Chesapeake Energy CEO Aubrey McClendon, "although, in our memories, as time goes by, you kind of link the two."

If anyone were to hold a grudge against Icahn for Kerr-McGee's departure, it might be McClendon, Chesapeake's co-founder. After all, McClendon's great uncle, Robert Kerr, founded Kerr-McGee, and his father, Joe McClendon, worked there for 35 years.

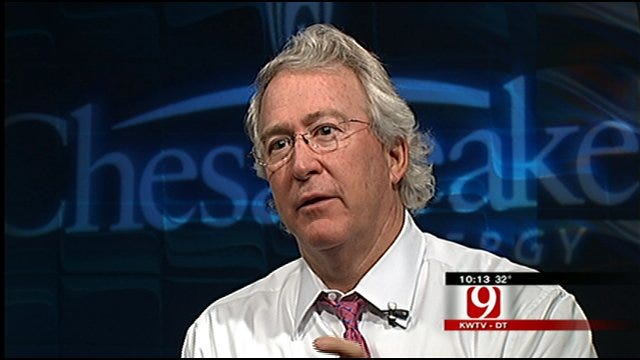

And yet, McClendon, in an exclusive one-on-one interview with our Oklahoma Impact Team, said he and Icahn are on very good terms.

That helps to explain his response when asked what went through his mind when he first learned that Icahn had increased his stake in Chesapeake to almost 6 percent.

"Well, I was talking to him just like this," McClendon said. "He handed it to me when I was in his office in New York."

What Icahn handed to McClendon was his "13D," a filing required by the Securities and Exchange Commission when a shareholder's position in a public company surpasses five percent. In the document, the purpose of the purchase is listed as Icahn's "belief that the shares were undervalued."

According to McClendon, the meeting was businesslike, but cordial: "He wanted to probe me to make sure he understands the reasons the stock was low."

At the time, Chesapeake stock was selling for about $23, a vast improvement from the $11.32 price recorded in December 2008, but still far below its $64 high from June 2008, and well off the pace of competitors, like Noble ($85), Anadarko ($66), and Devon ($75).

"That's classic Icahn, to find a company that isn't valued properly," explained oil and gas industry writer Bill Holland.

Holland, the associate editor of Gas Daily, says the consensus among industry analysts is that Chesapeake has been undervalued for a couple of reasons. First, because the price of natural gas is low, and Chesapeake's production has historically been geared almost entirely around natural gas. And, second, because of McClendon's aggressive management style.

Critics point to more than $11 billion in long-term debt on Chesapeake's balance sheet. Much of that debt has been racked up over the last few years in a massive land grab pursued by McClendon. Chesapeake is acknowledged, within the industry, to have acquired the best positions in every major shale field in the U.S., with 14 million acres of oil and gas assets, in total.

Holland says most analysts agree that Icahn's interest was not in stripping down Chesapeake, as, arguably, he did with Kerr-McGee, or in inserting himself onto Chesapeake's Board of Directors, as he threatened to do with Kerr-McGee. Rather, it seems Icahn was hoping that McClendon would understand how badly shareholders want him to reduce the company's debt, and get serious about doing it.

Most agree, if Chesapeake were to get its debt under control, its value would soar. And that could open the door to another possibility.

"What analysts have been talking about," Holland said, "is they think Icahn thinks that Chesapeake is going to get taken out by a much bigger company such as Conoco-Phillips, a national oil company such as British petroleum, or Total, of France"

We asked McClendon point blank if he sees that happening.

"I think it's remote, frankly," McClendon observed, "although as a public company, anything can happen."

McClendon doesn't see the company going anywhere except up.

He says they're beginning to see the benefits of a fundamental shift, begun two years ago, to increase the company's oil production and rely less on natural gas. And, he says, they are keeping a promise, made just after the new year, to reduce their long-term debt by 25 percent over the next two years, while, at the same time, scaling back production growth, from about 40 percent, to 25 percent annually.

"Just two months into our 25-25 plan we're already taking steps that at least get the first 25 out of the way," McClendon said.

This week, Chesapeake announced the latest in a series of asset sales -- 487,000 acres in the Fayetteville shale for $4.75 billion. McClendon says between $2 and $3 billion of the proceeds will go directly to debt reduction.

The stock market likes what McClendon is doing. Chesapeake shares were up $10 from mid-December to mid-February. And that means Icahn likes what he's doing. Last week, Icahn was even quoted as calling McClendon "sort of a genius."

"I think it's sort of a compliment," quipped McClendon. "I mean, he could've said I'm sort of a dummy, I guess."

One of the more common monikers given by others to the 51-year-old CEO has been 'gunslinger,' for what some see as his reckless, wild west-style aggression. McClendon says, in an industry as competitive as his, he could be called worse.

"You know, if you wake up at eight o'clock and go home at five," McClendon stated, "people aren't going to call you 'aggressive' or a 'gunslinger.' They're gonna call you 'loser.' I work five to eight so that other people can work eight to five, and that's just always been the way that I work."

More Like This

February 24th, 2011

April 15th, 2024

April 12th, 2024

March 14th, 2024

Top Headlines

April 23rd, 2024