Amazon Tax Makes Impact On Tulsa City Revenue

<p>The first receipts are in and giving a better idea of what sales tax collections on Amazon can mean for Tulsa.</p>Wednesday, May 17th 2017, 6:14 pm

The first receipts are in and giving a better idea of what sales tax collections on Amazon can mean for Tulsa.

The month to month jump was big - $3.2 million, but not all of that is Amazon. The City knows how much but can't say.

When people buy lunch from a food truck they pay sales tax and probably don't even realize it, it's just rolled into the tab.

But some Amazon customers are just now recognizing they're paying sales taxes there as well.

"I actually noticed it for the first time last night,” Gina Mullins said. “It didn't stop me from purchasing, but it was kind of a shock."

Mullins said her family spends between $500 and $1,000 a month on Amazon.

"All of our household supplies, clothing for my daughter, pool supplies, pretty much anything that isn't perishable we buy on Amazon and have delivered to our house," she said.

Tulsa's new sales tax numbers reflect some Amazon spending.

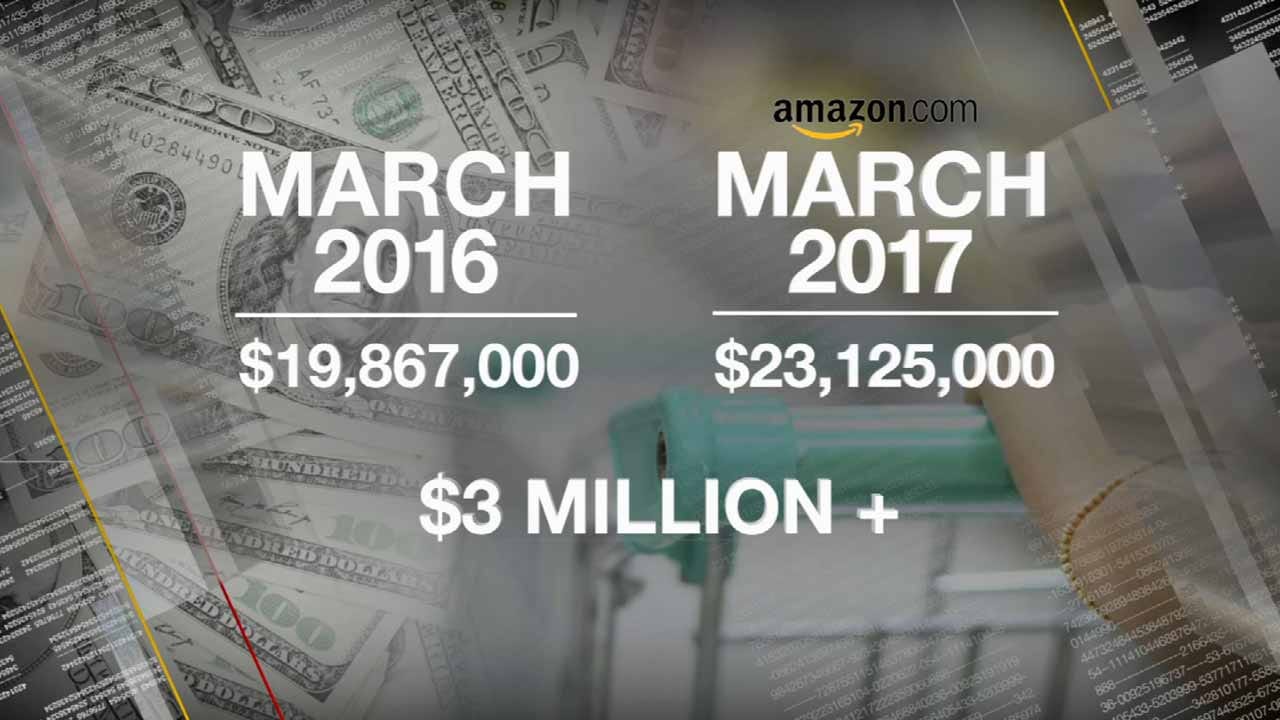

One year ago, the City took in $19,867,000 in sales tax for the month, but with Amazon in the mix, last month it was $23,125,000.

The year to year increase was more than $3 million a month. From one month to the next, the increase was $1.6 million.

The increase was figured into the budget even though the exact impact of Amazon was unknown.

Those numbers - and the impact of other online stores collecting tax - is only expected to grow.

Amazon started collecting sales tax March 1.

A lot of other companies do not collect the tax, and if they don't, it's up to customers to voluntarily pay the sales tax on their tax return.

More Like This

May 17th, 2017

September 29th, 2024

September 17th, 2024

Top Headlines

December 12th, 2024

December 12th, 2024

December 12th, 2024