Green Country Nonprofit Worries Fiscal Cliff Will Diminish Donations

The worry is over a possible limit on tax write-offs you can take, including giving to charities.Tuesday, December 4th 2012, 4:44 pm

Political leaders and taxpayers aren't the only ones concerned about the Fiscal Cliff; so are many nonprofit groups and charities.

The worry is over a possible limit on tax write-offs you can take, including giving to charities.

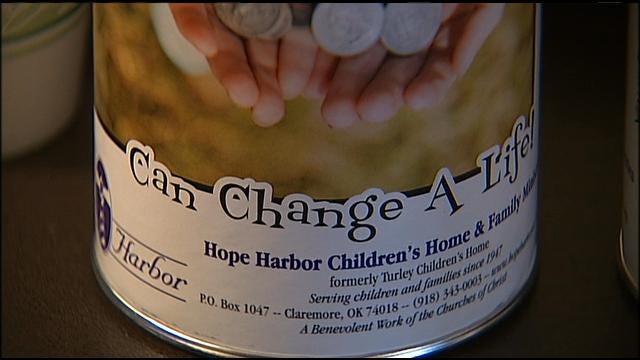

At Hope Harbor Children's Home near Claremore, children get plenty of individual time in the classroom, and attention in so many other areas.

"[We provide] individual counseling and family counseling and group work with the kids," said Hope Harbor Executive Director Ralph Richardson.

They work to get troubled kids to believe in themselves and their futures, plus offer services, including spiritual help, beyond the campus.

10/24/2012 Related Story: Claremore Outreach Program Helps Clothe Students For Winter

"Helping to restore families and bring people together who really have reached a place where they don't know how to interact and be a family anymore," Richardson said.

It's all made possible through private donations.

But now, if legislators allow the country to go over the Fiscal Cliff, it could get harder to raise funds.

To offset automatic cuts and tax hikes, an alternative proposal being considered is capping itemized deductions on taxes for some, which would include charitable deductions.

"Any increased challenges, at a time when every nonprofit - that I know, at least - is already struggling to kind of keep things going, is a concern," Richardson said.

Bill Flanagan is a CPA and the Hope Harbor Board President.

He's concerned about any caps on charitable write-offs.

"Anything that shrinks our pie, affects our programs, our ability to help kids and help the people we're trying to serve," Flanagan said.

The worry is tax hikes across the board, which will mean people will have fewer discretionary dollars to donate.

12/4/2012 Related Story: Oklahoma Governor Attends Fiscal Cliff Meeting At White House

And if you limit charitable write-offs, on top of that, it could leave even less for charitable organizations.

"If you don't have the revenue, it affects your expenses and it affects your mission," Flanagan said.

"Where we can't control what happens legislatively, what we do know is, in 2013, we're going to have our sleeves rolled up and work harder than ever to try to raise the dollars that it takes to provide these services for kids and families," Richardson said.

The Oklahoma Center for Nonprofits is urging charities to contact U.S. Congress members immediately with concerns.

They also say if funding cuts are made to public programs, nonprofits will see increased demand, making any limits on charitable write-offs even harder to overcome.

More Like This

December 4th, 2012

September 29th, 2024

September 17th, 2024

Top Headlines

December 12th, 2024

December 12th, 2024

December 12th, 2024