Group Says Bill To Eliminate Oklahoma Income Tax Flawed

Governor Fallin has been pushing to reduce the state income tax. The bill that just passed in the House is bringing that goal one step closer. But it's also frustrating others.Monday, March 19th 2012, 9:43 pm

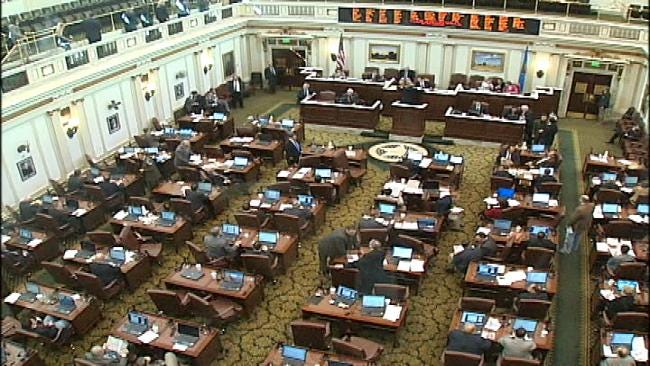

Republicans in the Oklahoma legislature are moving forward with a plan to phase out the state's personal income tax over the next 10 years.

03/12/2012 Related Story: Oklahoma Senate Approves Bill To Cut, Eliminate Income Tax

Governor Fallin has been pushing to reduce the state income tax. The bill that just passed in the House is bringing that goal one step closer. But it's also frustrating others.

"This is not what we need to be a healthier state, better educated state," said David Blatt with the Oklahoma Policy Institute.

The Oklahoma Policy Institute has been an active voice in the debate over the proposed elimination of the state's personal income tax.

"Without the income tax, there's really going to be no way we're going to be able to take care of people providing the services that are needed," Blatt said.

They argue no state income tax means more cuts to education, less funding for disabled Oklahomans, and possibly higher sales and property taxes.

"I think most Oklahomans would rather not be paying more at the grocery store or when filling up their car with gas or when their annual property tax bill comes around," Blatt said.

Lawmakers have proposed gradually reducing the current top tax rate of 5.25-percent until it hits zero percent in 2022.

Currently, there are only nine states in the U.S. that do not have a state income tax.

"A ten year phase out of the Oklahoma personal income tax would result in Oklahoma having the lowest income tax burden of any state in the Union," said State Representative David Brunbaugh.

Republican Representative David Brunbaugh says that instead of increasing other taxes, legislators are looking for ways to save in other departments.

"We're actually looking at everything across the board, all agencies. We're going to be looking at waste inefficiencies and non-core services to look at where we can identify savings," Brunbaugh said.

However, Blatt says if the current system isn't broken, then why fix it?

"Right now we're winning the game. Why would we want to throw a Hail Mary when in fact we're already ahead?" Blatt said.

The bill is headed to the Senate.

More Like This

March 19th, 2012

September 29th, 2024

September 17th, 2024

Top Headlines

December 11th, 2024

December 11th, 2024

December 11th, 2024

December 11th, 2024