Questionable Tax Credits Insulate Oklahoma's Shrinking Coal Industry

Some say Oklahoma's coal credits are breaking the state's bank for naught, funneling millions of dollars into the state's waning coal industry.Thursday, September 15th 2011, 10:44 pm

By Jennifer Loren, Oklahoma Impact

OKLAHOMA CITY -- Right now Oklahoma gives up an estimated $5.6 billion a year to tax expenditures, many of which are tax credits. That's almost 90 percent of last year's total state revenue.

Lurking amongst the widely unknown world of tax credits are a couple of tax breaks for the coal industry: Oklahoma's coal credits. Some say the coal credits are breaking Oklahoma's bank for naught, funneling millions of dollars into the state's waning coal industry.

It turns out many companies aren't even using the credits toward their taxes. They're pocketing the cash.

The Industry

Clay Hartley is the man in charge of selling coal mined by Phoenix Coal, a small company out of Vinita, Oklahoma. Right now the company has two active mining sites: one in Oklahoma, near Chelsea, and one in Kansas. We spent a day with Hartley at the company's Oklahoma mining operation.

"So this is your money maker?" I asked. "Yes," replied Hartley, picking up a handful of black coal from the sparkling mountains of coarse rocks surrounding us.

It's the company's money-maker because, unlike most Oklahoma coal, it's not high in sulfur. Federal air quality standards make high-sulfur coal less desirable and therefore less economical to mine and sell. Low sulfur Oklahoma coal is relatively rare.

Oklahoma's coal industry is small. It provides less than one percent of the nation's coal and employs a little more than 200 Oklahomans.

"It's an extremely tight, tough business right here," said Jim Brakefield of Brakefield Equipment, a partner of Phoenix Coal. "And the competition is pretty tough these days and times too."

But a recent OSU economic impact study estimates, through the ripple effect, the industry actually supports more than 1,000 jobs generating $42 million in Oklahoma income and creates more than $146 million in total economic activity.

the industry actually supports more than 1,000 jobs generating $42 million in Oklahoma income and creates more than $146 million in total economic activity.

Coal miners say their expenditures are significant. From drills to explosives to trucks the size of a small house, miners spend money to make money. They say they make it a point to spend their money in Oklahoma.

To give you an example of their expenditures, Brakefield pays $30 thousand per tire for one of his three monster-sized dump trucks. The trucks themselves cost more than $2 million each. He says Brakefield Equipment has more than $20 million in equipment on one site. Plus, he says, his workers make high salaries.

Click here to learn more about Oklahoma Coal Mining

But miners say tougher environmental regulations, higher operating costs and a thin Oklahoma coal seam make it increasingly difficult to keep operations profitable and competitive.

They say Oklahoma's coal tax credits have helped their industry survive and, if eliminated, may kill it.

"It's going to make it a lot tougher to stay in business here," worried Brakefield.

The Task Force

"We're not in the business of keeping people in business," said State Representative David Dank of Oklahoma City.

Representative Dank is leading a legislative task force investigating certain tax expenditures. The coal credits are on its list.

Dank says the coal credits are the result of last-minute legislation for coal's special interest group, have cost the state up to $16 million a year and need to be eliminated.

"Tax credits need to be based on jobs, and they need to be benefiting the taxpayers," said Dank. "If they're not, we need to get rid of them."

Dank said he supports other tax credits, like those for Oklahoma's oil and natural gas industries, because those industries support thousands of Oklahoma jobs.

The Credits

There are two coal tax credits.

One credit is for Oklahoma coal consumers like LaFarge. It receives a five dollar tax credit for every ton of Oklahoma coal it uses to make cement.

Tulsa plant manager Jim Bachmann says a permanent moratorium on that coal credit could affect LaFarge's decision making when it comes to purchasing fuel. But, he says, Lafarge is diversifying its energy portfolio and continues to rely less on coal. Ultimately, he says, if the tax credit is eliminated his plant would not only survive, it would likely still buy Oklahoma coal.

"I think the coal in Oklahoma would be the most cost-effective source of fossil fuels," said Bachmann.

Click here to see how LaFarge manufactures cement using coal

The second credit goes to Oklahoma coal producers: five dollars for every ton produced.

At Phoenix's Oklahoma mine alone, that would be at least a $2.75 million tax credit for one year. The VP of Phoenix Coal says he'd like to see another study done specifically analyzing those credits and their economic impact before they're eliminated.

"You have to justify them, and I want to. If we get our tax credits, we need to justify it to the state," said Clay Hartley of Phoenix Coal.

Both coal credits were suspended in 2010 as part of a two-year budget deal, but both are set to go back in effect July of 2012. But even through the two-year moratorium, taxpayers are still cashing in on coal credits earned in years past.

The Transfers

It turns out Phoenix Coal and others like it are not even using some of their tax credits. Most coal companies and coal consumers earn more credits than they owe in taxes.

After the companies have fulfilled their tax burdens with their credits, they sell the extra credits to taxpayers outside the coal industry at a discount. Some sell all of their credits. It's called transferability.

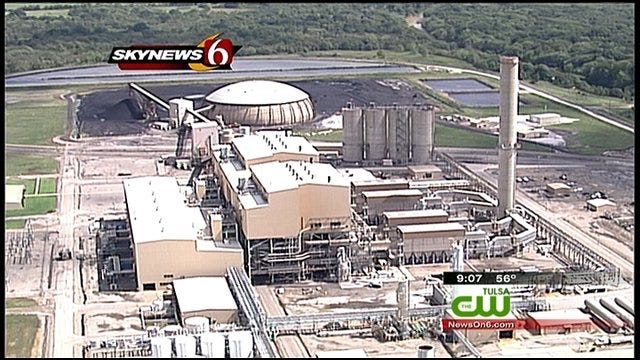

One of the driving forces behind the coal credits and their transferability is Lundy Kiger, a liaison and lobbyist for a power plant near Poteau, AES Shady Point. Over the years Kiger was key in convincing legislators to pass the various pieces of legislation that have subsidized Oklahoma's coal consumers.

Kiger confirmed that AES Shady Point does not use any of its tax credits toward its actual taxes. The power plant sells all of their credits to help its bottom line.

In an e-mail to the Oklahoma Impact Team, Kiger said, "Our biggest problem is the price difference between state coal and coal from Wyoming. So we use all the credits to offset the price difference in coal to help make state coal more affordable related to our budget."

Kiger would not tell us the price difference between Oklahoma and Wyoming coal, but said he sold the tax credits for about 92 cents on the dollar. He says he personally sought out the companies and individuals who buy AES's credits, mostly to reduce their income tax payments. The majority of the coal credits that have been sold were sold to Oklahoma insurance companies and firms.

According to our calculations, in 2008 AES Shady Point sold about $2.7 million in credits for about $2.5 million in cash. The power plant put that money toward its bottom line. The taxpayers who bought the credits got a tax break they didn't earn.

The Cost

A spokesperson for the Oklahoma Tax Commission, Paula Ross, could not tell us exactly how many taxpayer dollars have gone toward the coal credits over the years. Ross says the agency didn't begin compiling coal credit data until 2007.

In an e-mail to the Oklahoma Impact Team Ross said, "It is difficult to explain but we basically administer the tax laws and deposit state money. If the legislation requires totals we comply."

Click here for the Tax Commission's Latest Estimate

The Next Step

The coal credits will go back into effect in July of 2012 unless Legislators vote to eliminate them. Representative Dank plans to author legislation banning all transferable tax credits.

"I think the transferability is totally unconstitutional," said Representative Dank.

The legislative task force will continue to meet this year to investigate tax credits, including the coal credits. Representative Dank says it will make a recommendation to state lawmakers before the next legislative session.

Related Story: 12/08/10 Oklahoma Power Plant fails to Address Fly Ash Problem

More Like This

September 15th, 2011

September 29th, 2024

September 17th, 2024

Top Headlines

December 14th, 2024

December 14th, 2024

December 14th, 2024