Oklahoma Shoppers Urged To Beware Of Sales Tax In Online Holiday Purchases

There could be a lasting cost to all those cyber sales. Many websites don't charge sales tax and you are liable come tax season if you don't report it. <br /><br /><a href="http://www.oktax.state.ok.us/" target="_blank">Oklahoma Tax Commission</a>Monday, November 29th 2010, 8:43 pm

Lacie Lowry, News On 6

TULSA, Oklahoma -- Cyber Monday is the kickoff of the Internet shopping season. To make sure the deals last, the biggest retailers, like Wal-Mart and Best Buy, are extending Cyber Monday discounts all week.

But there's a lasting cost to all those cyber sales. Many websites don't charge sales tax and you are liable come tax season if you don't report it.

Amazon.com is one of the most visited sites for online holiday shopping and a News On 6 viewer contacted us after his Amazon experience.

"They do not collect the Oklahoma sales taxes…which means that at the end of the year, I have to fill out forms for all my purchases and pay the taxes on it. I do hate surprises like this," Chris Maxwell said in an email to News On 6.

It's true. Out-of-state vendors are not required by law to collect Oklahoma tax if they have no physical presence in Oklahoma. But shoppers still have to pay up.

"If you are not being charged sales tax, don't let that be a misnomer," said Cuong Hoang, CPA. "That doesn't mean that you aren't responsible. You ARE responsible and you should track that."

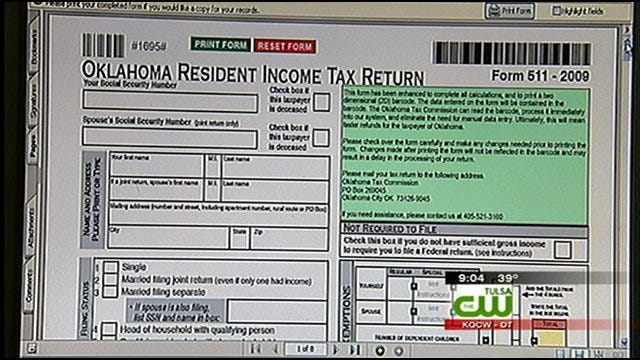

What you must pay instead is called a Use Tax, which is found on Line 20 of your income tax return.

"It asks you, "Are you subject to use tax, so there's a yes or no box and that's what that question is asking you," Hoang said.

The Use Tax is equivalent to the sales tax. You can itemize using your online receipts or calculate what you owe with a tax table. The Oklahoma Tax Commission has come up with an additional payment option.

"We've created a mechanism so consumers can pay use tax in a variety of ways. They can even pay online through our website with the Use Tax Online Payment System," said Paula Ross, a spokeswoman for the Oklahoma Tax Commission.

So the next time you let your fingers do the shopping, pay attention to whether you are charged sales tax.

Oklahoma is pushing for a new law to force out-of-state companies to pay sales tax on items sold to Oklahomans over the internet. Until that happens, you are liable for the use tax.

More Like This

November 29th, 2010

April 15th, 2024

April 12th, 2024

March 14th, 2024

Top Headlines

April 23rd, 2024

April 23rd, 2024

April 23rd, 2024

April 23rd, 2024