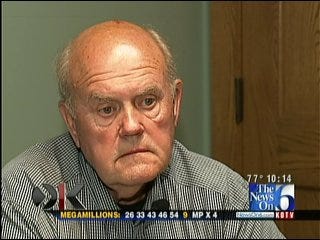

One Of Oklahoma's Top Tax Delinquents Speaks Out

In his first television interview since being released from federal prison, Jay Jones says he's not a tax cheat. <br /><br /><a href="http://www.newson6.com/Global/story.asp?S=12464077">State Of Oklahoma: $200 Million In Delinquent Taxes Are Uncollectable</a> | <a href="http://www.oktax.onenet.net/rpt/p/tw/top100.html" target="_blank">Top Oklahoma Tax Delinquents List</a>Tuesday, May 11th 2010, 11:43 pm

By Jennifer Loren, The Oklahoma Impact Team

TULSA, OK -- In his first television interview since being released from federal prison, Jay Jones says he's not a tax cheat.

The last time Jay Jones was in front of the camera, he was pleading guilty to a conspiracy charge in one of the biggest white-collar crimes in state history. The scandal bankrupted Tulsa-based Commercial Financial Services and left at least 1,500 people jobless.

Now Jones finds himself as the number five tax delinquent on Oklahoma's top 100 list, owing $2.5 million in back taxes.

"If I could I'd pay it. But I can't," said Jones.

5/11/2010 Related story: State Of Oklahoma: $200 Million In Delinquent Taxes Are Uncollectable

Three years after his release from prison, Jones says he has no way to pay. He works part time as a clerk at Tulsa's Brewster and DeAngelis law firm, making $11-thousand a year.

"Big money. Big money," Jones laughed.

We implied that his current lifestyle is a lot different from the lifestyle used to live.

"Boy, that would be an understatement. Yes ma'am," he replied.

Jones says he lives with his daughter and her family at their home in south Tulsa. The only asset he claims to have is a 2002 Chevrolet Tracker. Everything he used to own, he says, was taken by the government when he was sentenced. He says the government took about $200-million from him at that time.

He feels that money should have been applied to his tax liens.

We asked him if he feels like he owes the $2.5 million to the state of Oklahoma.

"No. I do not," Jones replied.

Jones owes $2.5 million to the Oklahoma Tax Commission, $813 thousand to the Internal Revenue Service and one billion dollars in restitution as part of his sentence.

A spokesperson for the Oklahoma Tax Commission says in cases like this, there's not much they can do.

"If they don't have the money to pay there's a point in society where that's just what's going to happen. I mean I think it's difficult," said Paula Ross with the Oklahoma Tax Commission.

Jones says he has been contacted by the tax commission's creditors, but feels they're wasting their time.

"I mean I'm happy to talk to them at any time. I have no secrets... or no assets," said Jones.

More Like This

May 11th, 2010

September 29th, 2024

September 17th, 2024

Top Headlines

December 11th, 2024

December 11th, 2024

December 11th, 2024

December 11th, 2024