Are Car Insurance Costs on the Rise in Your State?

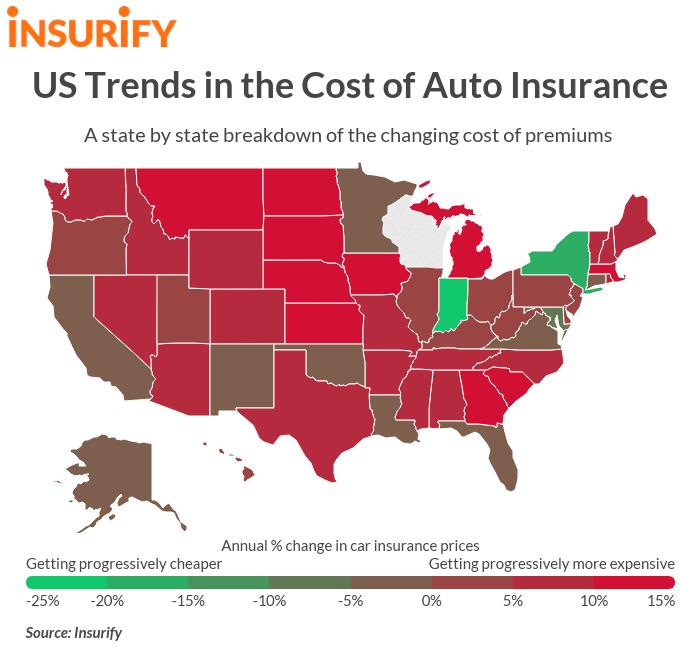

As we enter a new decade, which states have been seeing car insurance prices fall and which are trending higher and higher?Tuesday, January 14th 2020, 12:21 pm

As we enter a new decade, which states have been seeing car insurance prices fall and which are trending higher and higher?

No one likes paying car insurance bills; and no one likes the idea of those bills getting more and more expensive, especially when others’ are getting increasingly cheaper.

It’s no breaking news which state is home to the priciest auto insurance policies. Michigan has historically sky-high premiums, charging 72 percent more for car insurance than the next most expensive state. However, this doesn’t mean that car owners in other states should rest on their laurels, confident that they will always enjoy cheaper quotes for the same coverage. Pricing trends can matter just as much as costs themselves.

On this front, there‘s good news and bad news, so let’s begin with the good. There are in fact states in which quotes have been getting progressively lower in recent years. In fact, there are a dozen states where the average driver pays less for insurance today than they did in 2017.

Now for the bad news. In the approximately three dozen remaining states, the pricing outlook is not so rosy. Among these states, car owners are paying 22 percent more on average than they were 3 years ago.

So to ring in the new year, Insurify presents the state of insurance pricing trends in America going into 2020.

Insights

- A look back at 2017. Since 2017, American car owners have seen the cost of their insurance increase by 12.9 percent on average. For states in which costs have been trending upward, this increase is 21.5 percent, whereas for states in which prices have been falling, premiums have decreased by 12.4 percent in that time.

- National trends. In the past three years, national premium costs have risen an average of 4.5 percent annually. In states where quotes have risen, this figure has been 7.8 percent; and in those where rates have fallen, prices have decreased by approximately 6.0 percent.

- Fluctuation is normal. Trends are not laws, and just because statewide car insurance costs have been increasing or decreasing year to year, that doesn’t mean they will continue to do so. Aggregate costs, and especially individual policies, can shift up and down over time no matter where you live.

- Steady states. The cost of coverage in Florida, Oklahoma, and Virginia have held relatively steady since 2017, with the average price of insurance fluctuating less than $17 a month in each state.

Methods

The data science and research team at Insurify, a platform to compare auto insurance quotes, identified the average annual percent change in statewide prices. To do so, they analyzed their database of nearly 2 million American car insurance applications. By determining the yearly state by state pricing trends since 2017, they were able to rank the top 5 states with the steepest upward and downward rates of change. Wisconsin was excluded due to insufficient data. Statistics on mean monthly premiums and the absolute change in quote price from 2017 originates from Insurify’s proprietary database as well as from public filings.

States with the Steepest Downward Pricing Trends

5. New Mexico

- Average annual percent change: -4.0%

- Mean monthly rate: $166.07

- Cheapest insurer: USAA / State Farm for civilians

We kick off our list with the Land of Enchantment. With an average annual change of only -4.0 percent, New Mexico has the flattest pricing trend of any state in these top rankings. This is likely because the cost of quotes in New Mexico is in flux, swinging down and then back up again rather than gradually becoming less expensive year to year. For now, New Mexico drivers can only hope that these falling prices become less volatile as time goes on.

4. Connecticut

- Average annual percent change: -5.0%

- Mean monthly rate: $233.47

- Cheapest insurer: Travelers

Next up in the ranking, we have Connecticut. Despite the fact that Connecticut has among the most expensive home insurance in America, the cost of car insurance has been steadily falling. In fact, annual prices have lowered by almost $250 since 2017 alone.

3. Maryland

- Average annual percent change: -9.8%

- Mean monthly rate: $276.33

- Cheapest insurer: Erie

The cost of coverage in Maryland is trending downward by approximately 10 percent a year. This may partially relate to the fact that it has the ninth-lowest rate of traffic fatalities per vehicle miles traveled in the country. With both fewer miles of road and fewer deaths than the average state, there may be less risk for insurers to cover, resulting in more affordable prices.

2. New York

- Average annual percent change: -15.6%

- Mean monthly rate: $299.00

- Cheapest insurer: Preferred Mutual

Even though New York currently enjoys the second steepest trend toward cheap car insurance quotes — dropping in price an average of 15.6 percent a year — it is still the eighth-most expensive state for premiums. At the moment Preferred Mutual offers the cheapest mean rates across the state, but this title is constantly changing hands. What happens to be the cheapest company for the fabled “standard” driver may not be the best for you. That’s why it’s important to regularly compare auto insurance.

1. Indiana

- Average annual percent change: -23.2%

- Mean monthly rate: $163.96

- Cheapest insurer: Buckeye Insurance Group

The state with the fastest decreasing car insurance prices is the Hoosier State. This is an interesting top state for a number of reasons, chief among them being that Indiana tops several other insurance-related lists. Despite being the seventh most affordable state, Indiana has the eighth-most uninsured car owners in the nation, with 16.7 motorists driving without coverage. Perhaps if the cost of a policy continues to fall, more drivers will opt to insure their vehicles.

States with the Steepest Upward Pricing Trends

5. Georgia

- Average annual percent change: 11.6%

- Mean monthly rate: $301.82

- Cheapest insurer: Georgia Farm Bureau

Georgia has the fifth-fastest trend toward more expensive premiums, with costs having been steadily on the rise in the state for years. In 2018, the average monthly quote jumped by $32, only to be followed by a $47 spike in 2019. With the second-most expensive quotes on this ranking, these pricing surges are no laughing matter for Georgia drivers.

4. South Carolina

- Average annual percent change: 12.1%

- Mean monthly rate: $293.99

- Cheapest insurer: USAA / American National P&C for civilians

According to the most recent data released by the Bureau of Economic Analysis, South Carolina has the seventh-lowest personal income per capita in the United States. Nonetheless, it has the fourth-fastest growing car insurance rates nationwide. Costs have risen 35.5 percent since 2017, for an average total of $924 more in the annual cost of insurance.

3. Kansas

- Average annual percent change: 13.0%

- Mean monthly rate: $201.70

- Cheapest insurer: USAA / Auto-Owners Insurance Co for civilians

Number three on our top five list is the Sunflower State. Prices have increased 13 percent a year on average, so that Kansas drivers now pay approximately $60 more per month for the same coverage as they did in 2017.

2. Michigan

- Average annual percent change: 14.1%

- Mean monthly rate: $458.64

- Cheapest insurer: Metropolitan

Moving into 2020, Michigan insurance prices are on trend to increase by 14.1 percent. However, the reality is much more up in the air. This past May, the Michigan state legislature passed bipartisan automotive insurance reform that has the potential to save car owners hundreds of dollars on personal injury protection and the annual Michigan catastrophic claims fee. However, until the law takes effect this July, there’s no telling how the legislation will impact the cost of policies, as non-PIP coverage has no protections against price hikes under the bill.

1. Montana

- Average annual percent change: 15.8%

- Mean monthly rate: $179.26

- Cheapest insurer: USAA / State Farm for civilians

The state with the largest upward trend in insurance costs is Montana. Annual premiums have increased by approximately $360 each year, and show no signs of slowing moving into 2020. This may not be a distinction Montanans want, but it’s one that they can now claim, like it or not.

If you have questions or comments about this article, please contact insights@insurify.com.

Information contained on this page is provided by an independent third-party content provider. Frankly and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact pressreleases@franklymedia.com

More Like This

January 14th, 2020

December 13th, 2024

December 13th, 2024

December 13th, 2024

Top Headlines

December 13th, 2024

December 13th, 2024

December 13th, 2024

December 12th, 2024