House Passes Nearly $2 Trillion Build Back Better Act

The United States House of Representatives passed the nearly $2 trillion Build Back Better Act Friday morning, taking what President Biden says is “another giant step forward in carrying out my economic plan to create jobs, reduce costs, make our country more competitive, and give working people and the middle class a fighting chance.”Friday, November 19th 2021, 1:20 pm

WASHINGTON, D.C. -

The United States House of Representatives passed the nearly $2 trillion Build Back Better Act Friday morning, taking what President Biden says is “another giant step forward in carrying out my economic plan to create jobs, reduce costs, make our country more competitive, and give working people and the middle class a fighting chance.”

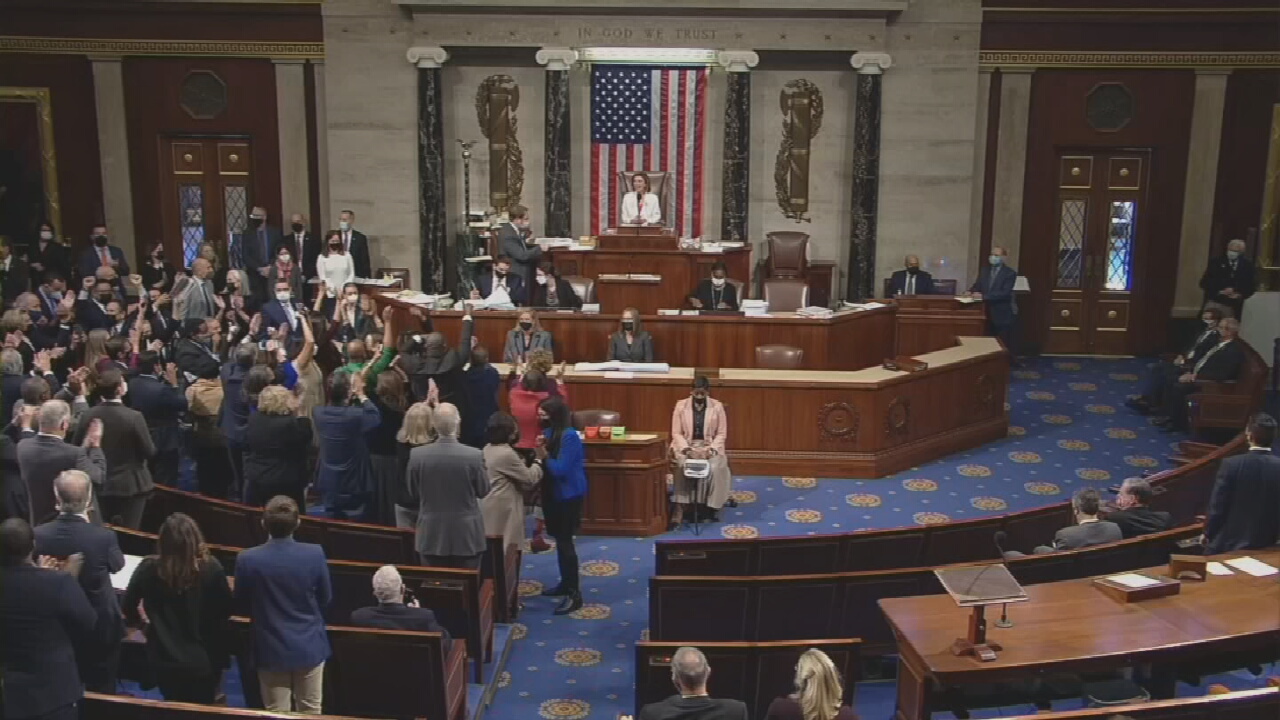

The announcement of the final vote, 220-213, by Speaker Nancy Pelosi (D-CA) elicited cheers from Democrats on the House floor, all but one of whom voted in favor of the partisan measure. Every member of the Oklahoma delegation and all other Republicans opposed it.

“The cheers on the other side are a little bit premature,” said Rep. Tom Cole (R-OK4) in an interview following the vote. “It’s going to the United States Senate, it’s not going to the president, and it’s going to change in the Senate.”

The vote culminates months of sometimes strained negotiations within the House Democratic caucus as moderates worked to reduce the bill’s original $3.5 trillion price tag and then insisted on seeing a ‘score’ from the nonpartisan Congressional Budget Office before being willing to vote.

The CBO released its score late Thursday, concluding the bill would cost about $160 billion over ten years, after taking into account revenue that could be generated by beefing up IRS tax audits, a feature of the bill Republicans have denounced.

“We are actually going to tax the American people $80 billion to hire 87,000 new IRS agents to go out and survey all every family, small business and farmer in America,” said Rep. Kevin Hern (R-OK1) in an interview earlier this week.

Other aspects of the legislation include:

• Universal preschool to cover more than 6 million three- and four-year-olds

• An expansion of Medicare coverage to cover hearing

• Several initiatives aimed at lowering the cost of prescription drugs, including insulin

• Health care subsidies for low-income Americans

• Initiatives to combat climate change, including electrification of the U.S Postal Service fleet

• Four weeks of paid family and medical leave

• An extension of the child tax credit through 2022 at $300 a month for each child under the age of 6 and $250 a month for each child ages 6-17

• Creation of a Civilian Climate Corps to fight the effects of a warming planet

Congressman Cole says there are certain items that, on their own, he might support, such as extending the child tax credit, but says there’s too much that’s not needed and goes too far.

“There’s always some things that you like,” Cole said, “but overall it’s a massive expansion of government, on top of all the spending we did in Covid.”

In addition to beefed-up IRS tax collections, the bill would be paid for primarily with increased taxes on wealthy corporations and a tax surcharge on the wealthiest Americans.

Republicans call it a step toward socialism. Democrats call it transformational.

“It’s a big win for the people,” said Rep. Stent Hoyer (D-MD).

More Like This

November 19th, 2021

December 13th, 2024

December 13th, 2024

December 13th, 2024

Top Headlines

December 13th, 2024

December 13th, 2024

December 13th, 2024

December 13th, 2024