Former Williams CEO Believes Merger Is Bad For Company, Tulsa

<p>A merger that's in the works between Tulsa's Williams Companies and a Texas company has so many red flags a former CEO believes they should try and get out of it.</p>Monday, February 1st 2016, 7:25 pm

A merger that's in the works between Tulsa's Williams Companies and a company in Texas has so many red flags Williams ought to try and get out of it.

That's the judgment of a former CEO who believes the merger isn't just bad for Williams, it's bad for Tulsa.

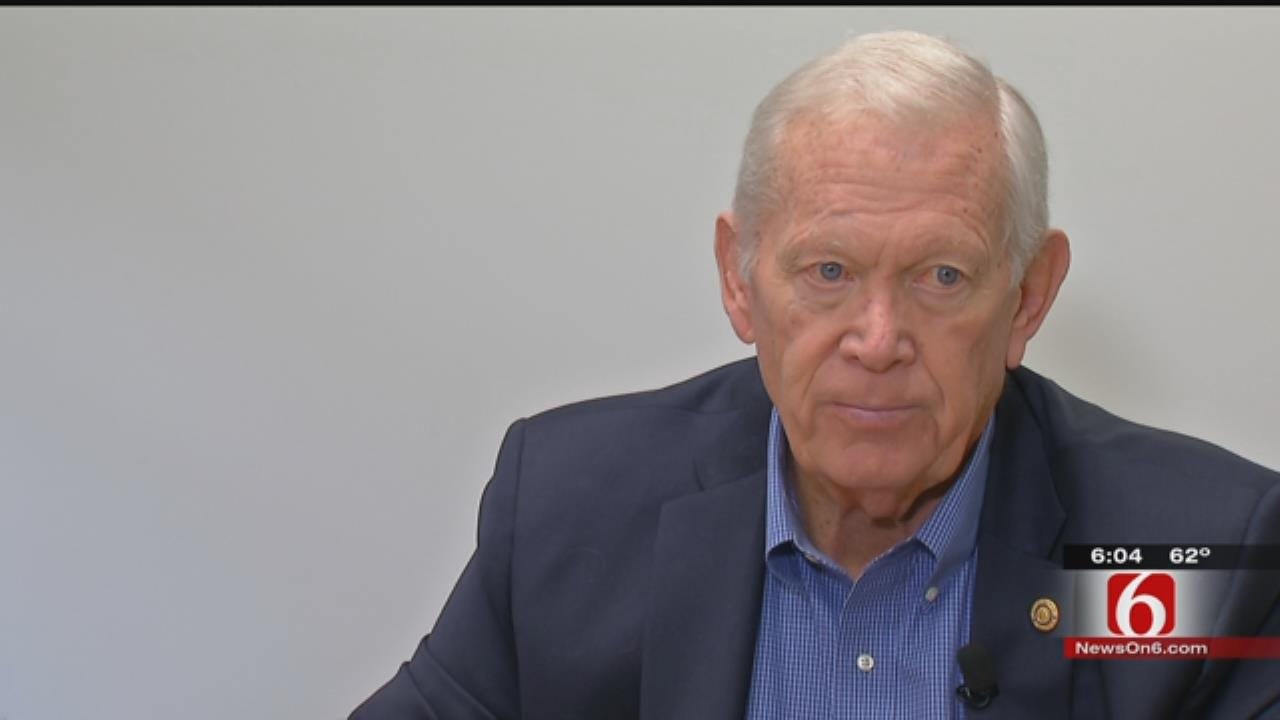

Through sheer payroll, influence and corporate charity, Williams is one of Tulsa's most important companies; and Keith Bailey, a retired CEO, said the current merger plan puts all of that in doubt.

9/28/2015 Related Story: Williams Merger Could Impact Tulsa-Area United Way

Bailey has reviewed the merger plan - both as a former CEO and still major shareholder - and he doesn't like it from either view.

"I didn't see anything in this transaction, even if you assume that it would make the businesses stronger, which I didn't, but if you did assume that, it was not going to be good for Tulsa," he said.

Williams has both bought and sold corporate divisions, but Bailey said it was always a fair deal.

He believes the Energy Transfer Equity deal is one-sided, and with the drop in oil prices and stock prices of both companies, the merger may not even be possible.

9/28/2015 Related Story: Tulsa's Williams Companies Announces Billion-Dollar Buyout Deal

Bailey said, "I think there are fair questions to be raised about whether they even have or will have the financial capacity to close the transaction that has been agreed to."

Few corporate leaders in Tulsa were as recognizable as Bailey during his decade leading Williams.

Now, he says he's most proud of how the company supported Tulsa with good jobs and corporate giving.

"When you lose a corporate citizen that has been as good as I believe Williams has been, that's a real negative for a community,” Bailey said.

With so much at stake for the company and the community, Bailey believes it's time for the Williams board to step back from the deal.

“The logical thing to do if the deal is foundering, and it certainly appears to me to be foundering for financial reasons, is to kind of - a no harm no foul deal - agree to agree and walk away, but there are probably egos at play and other things that make that difficult," he said.

While the markets could endanger the merger, shareholders are suing over it as well.

Our partner, The Frontier, will have more on this story Tuesday morning, including extended comments from Bailey.

More Like This

February 1st, 2016

September 29th, 2024

September 17th, 2024

Top Headlines

December 11th, 2024

December 11th, 2024

December 11th, 2024

December 11th, 2024