Years of Work Needed to Afford a Down Payment – 2020 Edition

Owning a home is a dream for many Americans, but it can be difficult to attain. Monthly costs, which can include mortgage payments, taxes and insurance, total an average of $1,082 nationwide, according to the Census...Wednesday, March 18th 2020, 3:04 am

By Nadia Ahmad, CEPF®

Owning a home is a dream for many Americans, but it can be difficult to attain. Monthly costs, which can include mortgage payments, taxes and insurance, total an average of $1,082 nationwide, according to the Census Bureau. And that’s after paying for the upfront costs of a home, including a down payment. Most people who don’t take out an FHA or conforming loan make a down payment of 20% the home value. In some cities, though, it can take much longer to afford a down payment than in others.

In this study, SmartAsset examined the number of years of work needed to afford a 20% down payment on the median home in each of the 50 largest cities in the U.S. To do this, we used median income figures and assumed that workers would save 20% of their income each year. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fourth look at how many years of work it takes to afford a down payment. Read the 2019 rankings here.

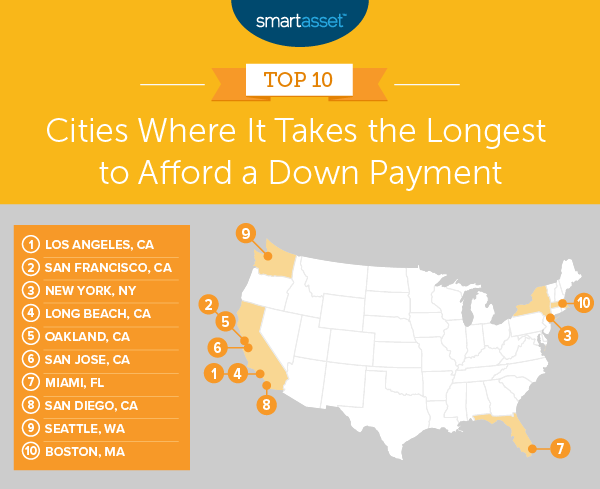

Key Findings- It takes the longest in California. Of the top 10 cities in our study, six are located in California: Los Angeles, San Francisco, Long Beach, Oakland, San Jose and San Diego. The average home value across all six of these cities is more than $803,000 and the number of years that the average household would need to work and save to afford a down payment is 9.58 years.

- Less of a wait in Midwestern and Southern cities. All 10 of the cities in our study where the average household would have to work the least amount of time to save for a 20% down payment are in Midwestern and Southern states. The median home value across these cities – which range from Tulsa, Oklahoma to Detroit, Michigan – is $137,260. The average number of years needed to work and save for a down payment on a home across these cities is 2.81 years.

1. Los Angeles, CA

Los Angeles, California is the U.S. city in which it would take the longest time to work to be able to afford a down payment – almost 11 years. The median home value in Los Angeles is $682,400, which makes a 20% down payment total more than $136,000.

Los Angeles residents who need further help managing finances to prepare for homeownership might wish to consult a local financial advisor.

2. San Francisco, CA

Using median income and home value, we estimate that the average San Francisco, California household would need to save for 10.64 years to afford a down payment, assuming a savings rate of 20% of pre-tax income each year. The median home value in the city is $1,195,700, the highest in the study. A 20% down payment on this home is approximately $239,000. San Francisco ranks behind Los Angeles because of a higher average income. The median household income in San Francisco in 2018 was $112,376 compared to $62,474 in Los Angeles.

Potential homebuyers who live in San Francisco but are not yet ready to stop renting might wish to consider searching for a roommate, as this living situation helps renters save the most relative to any other city.

3. New York, NY

New York City ranks as the third city with the highest average number of years of work needed to afford a down payment. It’s perhaps no surprise that it ranks No. 3, since it’s one of the cities where the average household is able to afford the least amount of home. Given the Census Bureau’s estimate of $63,799 as the median household income and assuming the ability to save 20% (or about $12,760) each year, the average household would need to work for more than 10 years to pay off a down payment in the city. This payment would be $129,020, which is 20% of the median value home, $645,100.

4. Long Beach, CA

The median household income in Long Beach, California is $61,610. The median home value in the city is about 10 times that amount, at $600,700. Assuming that the average household put away an annual savings of 20%, or about $12,300, it would take nine years and eight months of work to afford a down payment of $120,140 (20% of the median home value).

Women in this city who are looking for a new job to help them reach their homeownership goals may be interested in learning that Long Beach is one of the best cities for women in tech.

5. Oakland, CA

Oakland, California has the fourth-highest median home value in our study, at $717,700. The median household income in Oakland, $76,469, is approximately 11% of that. If the average household in the city were able to save about 20% of income each year – a total of about $15,294, or about $294 each week – it would take 9.39 years of work to afford a down payment.

6. San Jose, CA

In San Jose, California the average household would need to work approximately eight and a half years to save enough to afford a 20% down payment on the median-valued home in the city. The median home value in San Jose is $968,500, the second-highest across all 50 cities in our study. However, San Jose also has the highest median household income in the study, at $113,036, meaning that the amount saved may be higher on average.

7. Miami, FL

In Miami, Florida, the down payment on the median home in the city would total approximately $70,000 (which is 20% of $350,400). If annual savings for the average Miami household totaled $8,364 – about 20% of the median household income of $41,818 – they’d need 8.38 years to be able to afford a down payment on that home.

8. San Diego, CA

At $654,700, the median home value in San Diego, California is about $10,000 more than the median home value in New York City, but the median household income there (at almost $80,000) is almost $16,000 higher than that of New York. With higher incomes as one contributing factor, it would take almost two years less in San Diego – at about 8.22 years – for the average household to be able to afford a 20% down payment on the median value home in the city than it would in New York.

9. Seattle, WA

Given the median home value in the city of $758,200 in Seattle, Washington, a 20% down payment for that home exceeds $150,000. If the average household were able to save 20% of income, or about $18,700 a year ($1,558 each month), it would need just over eight years to afford a down payment.

10. Boston, MA

With an average home value of $575,200, a 20% down payment in Boston, Massachusetts would total $115,040. Given that the median household income in Boston is about $71,800, the average household would need to work for 8.01 years to save enough for this down payment, assuming a savings rate of 20% on pre-tax income each year.

Renters in Boston who are still unprepared to transition to homeownership might have some help in building their savings: In recent years, rent in Boston has been becoming more affordable.

Data and MethodologyTo rank the cities where the average household would need to save the longest to afford a down payment, we analyzed data on the 50 largest cities in America. We specifically considered two pieces of data:

- 2018 median home value.

- 2018 median household income.

Data for both factors comes from the Census Bureau’s 2018 1-year American Community Survey.

We started by determining the annual savings for households by assuming they would save 20% of the median annual pre-tax income. Next, we determined how much a 20% down payment for the median home in each city would cost. Then we divided the estimated down payment in each city by the estimated annual savings. The result was the estimated number of years of saving needed to afford a down payment, assuming zero savings to begin with. Finally, we created our final ranking by ordering the cities from the greatest number of years needed to the least number of years needed.

Tips for Managing Your Mortgage- Make sure you are ready. From down payments to monthly mortgage and maintenance costs, being a homeowner has its financial challenges. If you’re thinking about taking the leap, be sure your money matters stack up. Are you prepared to buy now, or should you rent for a little while longer? Our Rent vs. Buy calculator can help you figure out what’s best.

- Consider refinancing. If you’re not quite ready to sell but need to better manage your payments, consider refinancing your mortgage. This could be especially beneficial if interest rates have dropped since the time your purchased your home. Take a look at our refinance guide for more information.

- Top-tier advice. For a stronger strategy for how you might need to revamp your long-term plans to prepare for a big decision like purchasing a home, it’s extremely important to seek out the best financial advice, preferably from an expert. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/Ivan-balvan

The post Years of Work Needed to Afford a Down Payment – 2020 Edition appeared first on SmartAsset Blog.

Information contained on this page is provided by an independent third-party content provider. Frankly and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact pressreleases@franklymedia.com

More Like This

March 18th, 2020

December 15th, 2024

December 15th, 2024

December 15th, 2024

Top Headlines

December 15th, 2024

December 15th, 2024

December 15th, 2024

December 15th, 2024