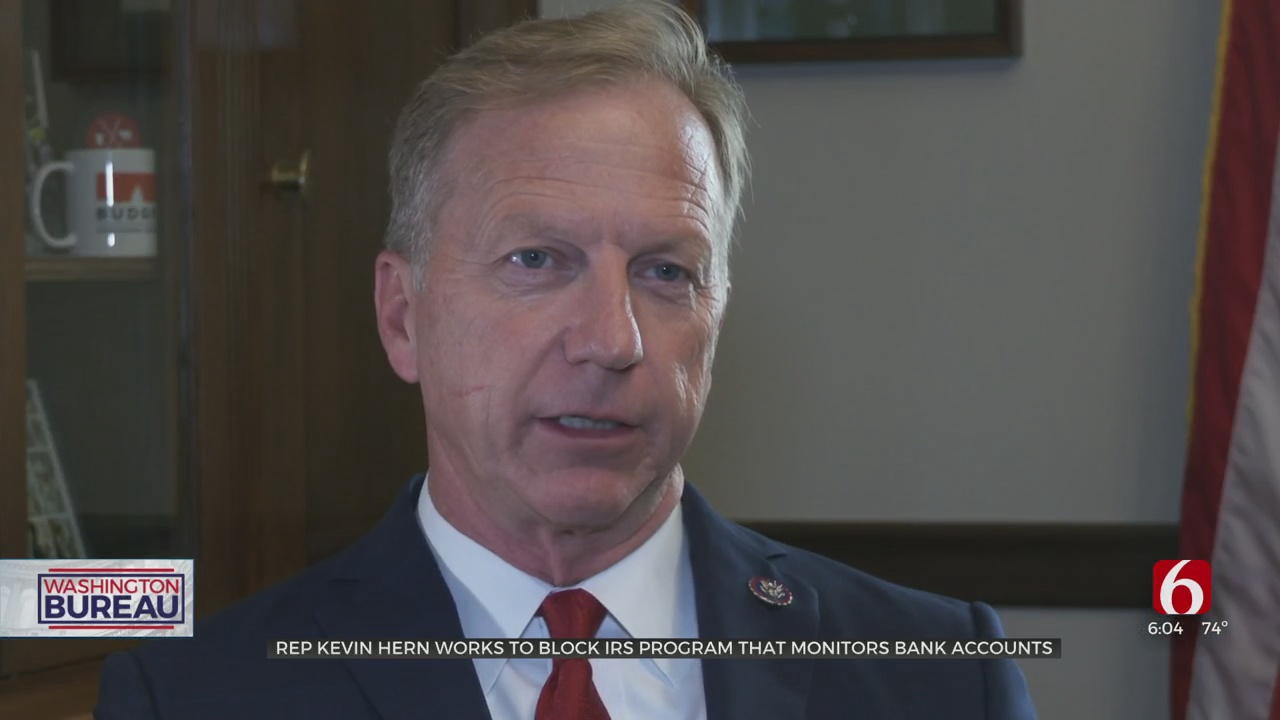

Oklahoma Congressman Hern Co-Sponsors Bill To Block Biden's IRS Reform

Oklahoma Congressman Kevin Hern (R-OK1) has signed on as a sponsor of legislation to block the Biden Administration’s effort to give the IRS greater insight into which taxpayers might be trying to cheat the system.Wednesday, October 20th 2021, 6:17 pm

WASHINGTON -

Oklahoma Congressman Kevin Hern (R-OK1) has signed on as a sponsor of legislation to block the Biden Administration’s effort to give the IRS greater insight into which taxpayers might be trying to cheat the system.

The ‘Prohibiting IRS Financial Surveillance Act’ would prevent the Internal Revenue Service from implementing any new reporting requirements for banks or other financial institutions.

The measure is in response to a still-evolving proposal by Democrats to help the IRS flag accounts to be audited by requiring banks report to tax authorities any account with cash inflow or outflow totaling more than $10,000, excluding normal wages and interest. Until this week, when Senate Democrats acquiesced to mounting pressure, the threshold for reporting had been $600.

Democrats and the Biden Administration believe the measure will help close the tax gap — the difference between what taxpayers owe and what they actually pay — and provide hundreds of billions of dollars for things like extending the child tax credit.

Even with the higher reporting threshold, the banking industry and Republicans firmly oppose the idea.

“I think it’s a witch hunt,” said Rep. Hern in an interview Wednesday.

Hern serves on the House Ways and Means Committee, which generally has jurisdiction in tax matters, and said this will only serve to give the IRS a free pass to “snoop around Americans’ personal finances trying to generate revenue that might not exist.”

“If there’s an egregious area or particular piece of the tax code that people are abusing,” said Hern, “then we should fix that or we should change the complexity of the tax code, but to go now and have every bank in America become an extension of the IRS, it’s just not right.”

Hern said House Ways and Means has yet to see the language of the measure, but is aware that its Senate sponsors agreed to raise the reporting threshold to $10,000, which he said still is too low.

“This is not about going after big business or medium-size businesses,” Rep. Hern said, “this is clearly about farmers and small businesses.”

Negotiations on the $3.5 trillion budget reconciliation package continue. The White House is trying to broker an agreement between moderate and progressive Democrats.

More Like This

October 20th, 2021

May 22nd, 2023

Top Headlines

December 15th, 2024

December 15th, 2024

December 15th, 2024

December 15th, 2024