Tulsa Professor: Understanding Retirement Fund Fees Could Make You Money

Many people overlook fees charged on 401-k plans or other retirement accounts, but if you pay attention it could seriously save you money.Tuesday, February 24th 2015, 6:12 pm

The Obama administration wants tougher rules on brokers who may be motivated by collecting fees instead of the best interests of people saving for retirement, but opponents say there are enough rules already.

While that debate is going back and forth, you can do something right now that could help your retirement savings.

Many people overlook fees charged on 401-k plans or other retirement accounts, but if you pay attention it could seriously save you money.

When many of us get quarterly investment reports in the mail, we might glance at the pie charts or graphs, but most of the time we just look at how well the account is doing, not so much the fine print of how much it costs to have someone administer that fund.

"We always need to find out what we're paying for the service that we're getting because there is not necessarily a strong correlation between how well your investment does and what your fees are that you get charged," said OSU Tulsa Finance Professor, Gary Trennepohl.

He's going to help us understand why it's so important to keep up with what we're paying in fees.

"If you give a percent a year or more in fee costs, then you have to earn more to make that up," Trennepohl said.

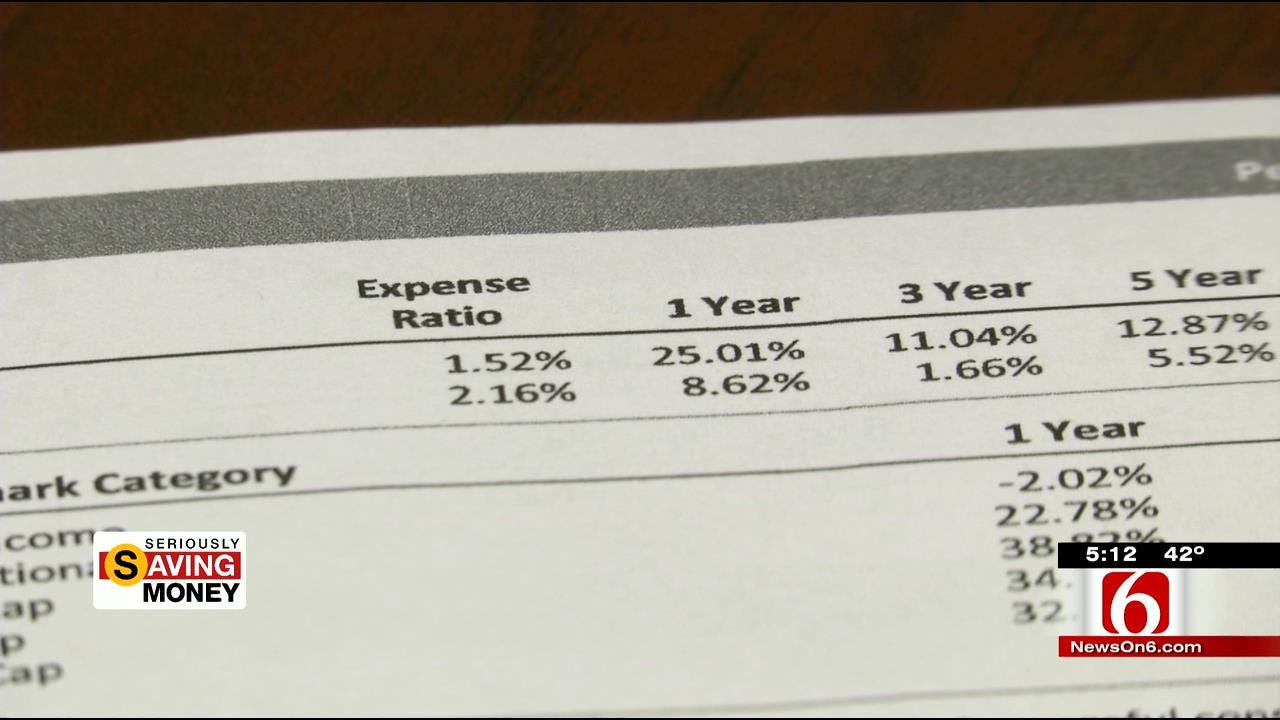

First, look for what is usually called the “expense ratio" on your statement.

For easy math, let's use the example of $100,000 in a 401-k. If your administrative fee is 1.5 percent, it would cost you $1,500 each year in fees. If the fee is half a percent, it's $500.

So you'd save $1,000 each year.

If you invested that $1,000 each year, over 30 years and averaged a seven percent return, that would be an extra $100,000 at retirement.

"Most people don't know this quote from Albert Einstein, he said ‘The most powerful force in the universe is compound interest,'" Trennepohl said.

So what would be a reasonable fee on our retirement accounts?

Usually you want to look for something under one percent. If your fees are higher than that you can shop around, or, if it's an employer sponsored 401-k plan, you can lobby your employer to look for options with lower fees.

You could also look into other investment funds in your current plan that might have lower fees.

More Like This

February 24th, 2015

September 29th, 2024

September 17th, 2024

Top Headlines

December 14th, 2024

December 14th, 2024

December 14th, 2024

December 14th, 2024