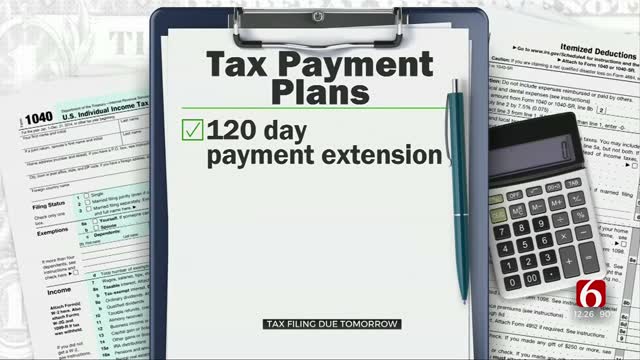

Deadline To File Taxes Approaching, Due July 15

Deadline To File Taxes Approaching, Due July 15Tuesday, July 14th 2020, 12:41 pm

The new Tax Day is quickly approaching.

The IRS moved the deadline from April 15th to July 15th because of the COVID-19 pandemic.

If you need more time to file you can get an extension until October 15th, but if you owe taxes then you'll need to estimate how much your tax payment needs to be and make that payment by July 15th.

If you don't have the money now, you can apply for a payment extension of up to 120 days or you can ask the IRS to set up an installment plan.

For anyone who lost their job during the pandemic, both state and federal unemployment benefits are taxable and will have to be paid next year.

More Like This

July 14th, 2020

October 25th, 2022

February 16th, 2022

February 14th, 2022

Top Headlines

December 14th, 2024

December 14th, 2024

December 14th, 2024

December 14th, 2024