Oklahoma's Own In Focus: Oklahoma To Cut State Sales Tax On Groceries

Tax relief is coming at the grocery store, where about half of the current sales tax will no longer apply once the tax cut, signed Tuesday, takes effect.Tuesday, February 27th 2024, 6:15 pm

Oklahoma's 4.5% state sales tax on groceries will soon be a thing of the past.

Tax relief is coming at the grocery store, where about half of the current sales tax will no longer apply once the tax cut, signed Tuesday, takes effect.

This won't make your grocery bill totally tax-free because the local tax collected by your city or county will remain in place.

While that number varies between cities, all shoppers will see the same reduction, 4.5%.

Though House Bill 1955 was signed on Tuesday, it takes effect 90 days after the legislature adjourns.

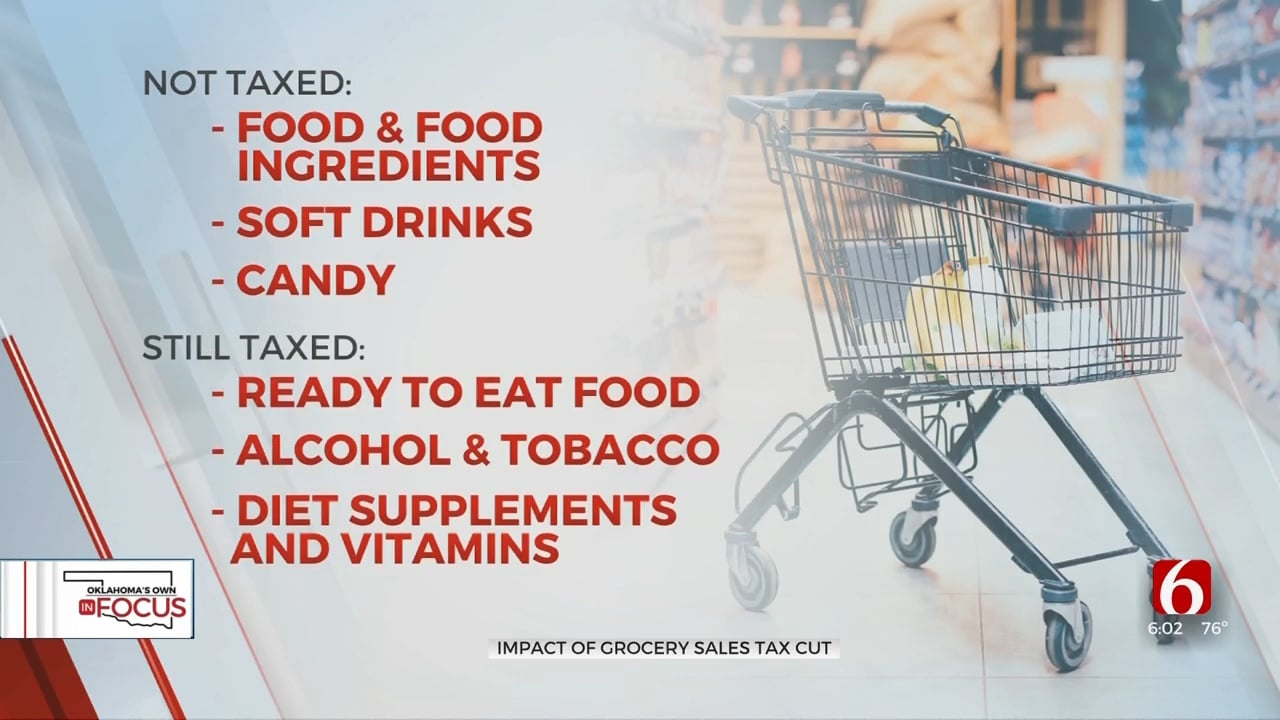

After that, state sales tax won't apply to food and food ingredients, soft drinks or candy. It will still apply to ready-to-eat food, alcohol, tobacco, diet supplements, and vitamins.

For $90 worth of groceries in Tulsa, taxes now make the bill $97.66. After the state tax is cut, the bill drops to $93.61.

City and County sales tax will still apply to every purchase, and that sales tax pays for local government.

Tulsa Mayor G.T. Bynum supports the cut in state taxes but said it wouldn’t work on the city level.

"If we eliminated the sales tax on groceries at a city level, it would have a catastrophic impact on Police and Fire Department staffing," he said.

The state portion of the sales tax on groceries generates about $400 million per year. Soon, it will be unavailable for the state to spend - instead, shoppers will keep that portion.

The change means Oklahoma joins the majority of states with no grocery tax, like Texas and Colorado, while Arkansas, Missouri and Kansas still do charge some tax on groceries.

In the law, there's a ban on cities raising their taxes to capture that 4.5% - at least for one year.

The state could one day reimpose the grocery tax, but it's much harder to raise taxes than cut them.

This tax cut comes as USDA data says Americans are spending more of their income on food than they have in 30 years.

Over the last four years, food prices have gone up at a faster rate than housing, medical care, clothing, and education.

In addition to inflation, the USDA says other factors have driven up food prices, including the pandemic, the war in Ukraine, and the 2022 bird flu outbreak.

More Like This

February 27th, 2024

December 12th, 2024

December 12th, 2024

December 12th, 2024

Top Headlines

December 12th, 2024

December 12th, 2024

December 12th, 2024

December 12th, 2024