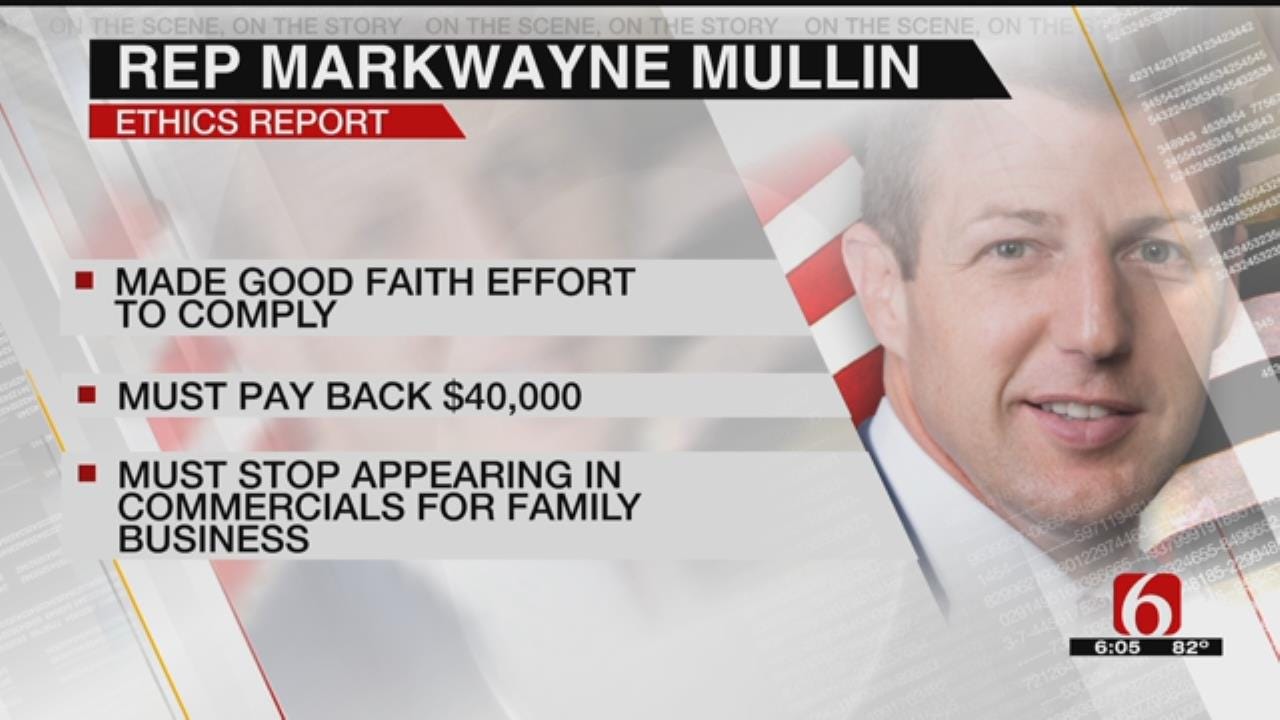

House Ethics Committee Says Rep. Mullin Must Return $40,000

<p>The U.S. House Ethics Committee says Representative Markwayne Mullin must return $40,000 and stop appearing in commercials for his family business.</p>Friday, August 10th 2018, 4:06 pm

The U.S. House Ethics Committee says Representative Markwayne Mullin must return $40,000 and stop appearing in commercials for his family business.

The committee released its report on Mullin's activities with his family businesses on Friday. In the report, it says in 2013 Mullin made a good faith effort to operate his family business in accordance with house rules, but that he had violated some rules when a company transferred to his wife paid him $40,000 dollars.

The report states Representative Mullin has consistently characterized these payments as “distributions” meaning a return on equity for capital he

invested in the companies, not salary or other compensation for services rendered to the companies.

OCE’s referral suggested that despite the “distribution” label applied to the payments, they were in fact compensation for Representative Mullin’s services to the Mullin Companies, namely the advertisements he continued to record for the companies after joining the House.

Representative Mullin issued a statement in response saying that he views this report as an attempt to discourage citizen legislators.

“As the Ethics Committee report clearly states, I have followed the guidance they provided since my first term in office,” said Mullin. “Now, the rules have changed.

“The new guidance in this report only proves that you can no longer be a citizen legislator. You have to be a career politician to serve in Washington, D.C.,” continued Mullin. “If I don’t fit the bill for a citizen legislator as a plumber, rancher, and someone who had never held a political office before, then who does?”

In a statement from Congressman Markwayne Mullin's office, Communications Director Amy Lawrence stated:

The $40,000 that must be “repaid” by Congressman Mullin is merely an accounting error. Mullin West operates as an S-Corps. The $40,000 was mistakenly paid into a joint account of he and his wife in order for them to pay end-of-year taxes on their businesses. He did not receive this sum as salary.

The full report can be read below.

More Like This

August 10th, 2018

September 29th, 2024

September 17th, 2024

Top Headlines

December 14th, 2024

December 14th, 2024

December 14th, 2024

December 14th, 2024