Oklahoma Voters Approve Six State Questions

Oklahoma voters approved the passage of six state questions at the polls on November 6, 2012.Tuesday, October 30th 2012, 5:15 pm

Oklahoma voters decided more than just who will represent them in the White House and Congress when they go to the polls on November 6, 2012. They approved the passage of six state questions.

See complete election results on NewsOn6.com.

Read a description of each question taken from the web site of the Oklahoma State Election Board:

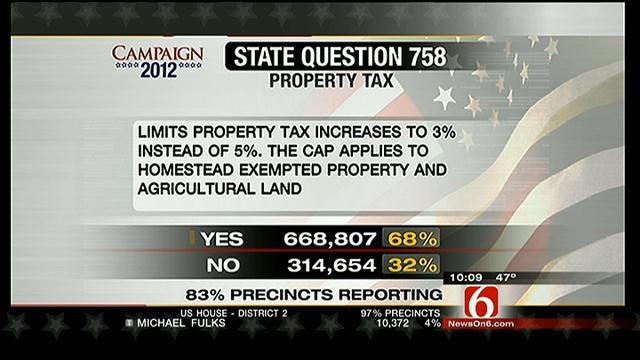

State Question 758: Property Tax

This measure amends the State Constitution. It amends Section 8B of Article 10.

The measure deals with real property taxes also called ad valorem taxes. These taxes are based on several factors. One factor is the fair cash value of the property.

The measure changes the limits on increases in fair cash value. Now, increases are limited to 5% of fair cash value in any taxable year.

The measure changes the cap on increases to 3% for some property. The 3% cap would apply to homestead exempted property. The cap would also apply to agricultural land.

The measure also removes obsolete language.

10/23/2012 Related Story: State Question 759 Seeks To End Affirmative Action On State Level

State Question 759: Affirmative Action

This measure adds a new section to the State Constitution. It adds Section 36 to Article II.

The measure deals with three areas of government action. These areas are employment, education and contracting. In these areas, the measure does not allow affirmative action programs. Affirmative action programs give preferred treatment based on race, color or gender. They also give preferred treatment based on ethnicity or national origin. Discrimination on these bases is also not permitted.

The measure permits affirmative action in three instances.

1. When gender is a bonafide qualification, it is allowed.

2. Existing court orders and consent decrees that require preferred treatment will continue and can be followed.

3. Affirmative action is allowed when needed to keep or obtain federal funds.

The measure applies to the State and its agencies. It applies to counties, cities and towns. It applies to school districts. It applies to other State subdivisions.

The measure applies only to actions taken after its approval by the people.

State Question 762: Parole Process

This measure amends Section 10 of Article 6 of the Oklahoma Constitution.

It changes current law, decreasing the power and authority of the Governor by removing the Governor from the parole process for persons convicted of certain offenses defined as nonviolent offenses. It enlarges the power and authority of the Pardon and Parole Board by authorizing that Board, in place of the Governor, to grant parole to persons convicted of certain offenses defined as nonviolent offenses.

The Legislature defines what offenses are nonviolent offenses and the Legislature may change that definition.

The measure authorizes the Pardon and Parole Board to recommend to the Governor, but not to itself grant, parole for persons convicted of certain offenses, specifically those offenses identified by law as crimes for which persons are required to serve not less than eighty-five percent of their sentence prior to being considered for parole and those designated by the Legislature as exceptions to nonviolent offenses.

For those offenses for which persons are required to serve a minimum mandatory period of confinement prior to being eligible to be considered for parole, the Pardon and Parole Board may not recommend parole until that period of confinement has been served.

State Question 764: Reserve Fund

This measure amends the Oklahoma Constitution. It adds a new Section 39A to Article 10.

It would allow the Oklahoma Water Resources Board to issue bonds. Any bonds issued would be used to provide a reserve fund for the Board. The fund would be a reserve fund for certain water resource and sewage treatment funding programs. The fund could only be used to pay other bonds and obligations for the funding programs. The bonds could only be issued after other monies and sources are use for repayment. The bonds would be general obligation bonds. Not more than Three Hundred Million Dollars worth of bonds could be issued. The Legislature would provide the monies to pay for the bonds.

The Legislature would provide for methods for issuing the bonds. The Legislature would provide for how the fund is administered.

State Question 765: Abolish DHS

The measure amends the Oklahoma Constitution.

It abolishes the Oklahoma Department of Human Services, the Oklahoma Commission of Human Services and the position of Director of the Oklahoma Department of Human Services. These entities were created under different names by Sections 2, 3 and 4 of Article 25 of the Oklahoma Constitution and given duties and responsibilities related to the care of the aged and needy. The measure repeals these sections of the Constitution and consequently, removes the power of the Commission of Human Services to establish policy and adopt rules and regulations.

Under the measure, the Legislature and the people by initiative petition retain the power to adopt legislation for these purposes.

The measure adds a provision to the Constitution authorizing the Legislature to create a department or departments to administer and carry out laws to provide for the care of the aged and the needy. The measure also authorizes the Legislature to enact laws requiring the newly-created department or departments to perform other duties.

10/17/2012 Related Story: Supporters Say State Question 766 Could Impact State Job Growth

State Question 766: Intangible Property

This measure amends Section 6A of Article 10 of the Oklahoma Constitution.

At present that section exempts some intangible personal property from ad valorem property taxation. This measure would exempt all intangible personal property from ad valorem property taxation.

An ad valorem property tax is a tax imposed upon the value of property. Intangible Personal Property is property whose value is not derived from its physical attributes, but rather from what it represents or evidences.

Intangible Personal Property which is still currently taxed but would not be taxed if the measure is adopted, includes items such as:

- patents, inventions, formulas, designs, and trade secrets;

- licenses, franchise, and contracts;

- land leases, mineral interests, and insurance policies;

- custom computer software; and

- trademarks, trade names and brand names.

If adopted, the measure would apply to property taxation starting with the tax year that begins on January 1, 2013.

More Like This

October 30th, 2012

September 29th, 2024

September 17th, 2024

Top Headlines

December 15th, 2024

December 15th, 2024

December 15th, 2024

December 15th, 2024