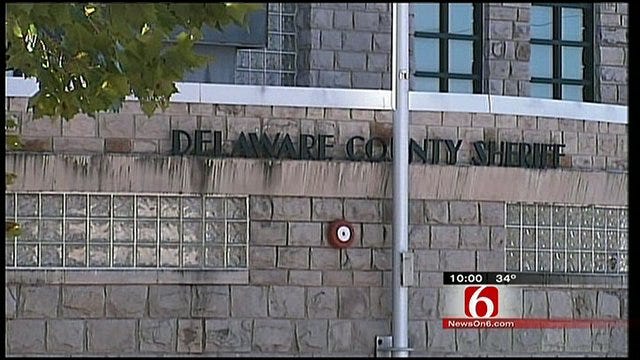

Delaware County Residents Discuss Ways To Pay $13 Million Sex Settlement

Delaware County taxpayers held a meeting Thursday to discuss ways to pay a $13 million payoff to settle a lawsuit against the sheriff's department.Thursday, January 19th 2012, 10:56 pm

KANSAS, Oklahoma -- Delaware County taxpayers held a meeting Thursday to discuss ways to pay a $13 million payoff to settle a lawsuit against the sheriff's department.

Taxpayers are still angry over paying off former inmates who accused a jailer and sheriff's deputy of sexual misconduct up to and including rape. But now that they're stuck with the cost of a settlement - they want to change how it's paid off.

A classroom at Northeast Technology Center was packed with more than 150 people. They wanted to hear about the options to pay off a $13 million court settlement.

"It's going to increase the burden on the taxpayers greatly, it really is," said Delaware County resident Sam Andrews.

Andrews and several other landowners are promoting a 17 year sales tax that everyone would pay, instead of a 3 year property tax levied on a relative few.

"I had rather pay a nickel on $10 for something that I want and bought, because I'm not going to miss that nickel so much and we can get this paid for painlessly," said Bobbi Parris, sales tax proponent.

Taxpayers are on the hook for a settlement over sexual assaults at the jail and during prisoner transports.

Fifteen female inmates sued, the county settled, leaving taxpayers with an 18 percent property tax increase - unless they vote for a half cent sales tax instead.

"We're going to have to pay for it. With sales tax we'd get a little bit of help with tourism and the burden wouldn't be purely on the landowner," Andrews said.

County Commissioner Bill Cornell says an increase on property taxes could cost more down the line.

"The chances of ever getting a school bond issue passed, it would probably not ever happen," said Bill Cornell, Delaware County Commissioner.

Bobbi Parris says everyone should have been watching the government before now.

"I think this has opened up a lot of people's eyes that we need to be stay more involved in what our county officials are doing," Parris said.

The sales tax increase will go up for election April 3, 2012, and will start in July. If it's not approved, property taxes will go up next January.

More Like This

January 19th, 2012

April 15th, 2024

April 12th, 2024

March 14th, 2024

Top Headlines

May 6th, 2024