Is It Legal For Credit Card Companies To Add Authorization Holds To Your Account?

All credit card companies allow you to dispute a charge but what happens when a company adds an unexpected charge to your account? <br /><br /><a href="http://www.newson6.com/Global/category.asp?C=150501&nav=menu682_11_6" target="_self">Good Question</a>Thursday, July 29th 2010, 6:05 pm

By Lacie Lowry, The News On 6

UNDATED -- All credit card companies allow you to dispute a charge but what happens when a company adds an unexpected charge to your account?

A Tulsa viewer recently discovered holds on her account and wanted to know why.

Sharon Humphrey just got back from a dream vacation and a financial nightmare was waiting for her.

"I was exasperated," she said.

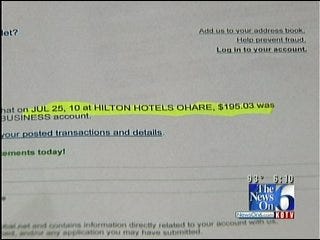

She stayed at a Hilton hotel for $195 and rented from Hertz rent a car for $21. But the companies put what's called an authorization hold on her account: an extra $245 for the room and an extra $162 for the car.

"That puts double charges on my credit card so that, for example, the $245 was another $245 that I don't get to use for three to four days," Humphrey said.

The holds were eventually released. Still, Sharon can't let go of her concerns.

"My question is, is it legal?" she asked.

"It's absolutely legal," said Rick Brinkley, with the Better Business Bureau.

Brinkley said authorization holds are the way credit card companies protect themselves.

"They want to make sure that not only is there the ability to pay for the immediate charge, but they also want to make sure you have the ability to pay for any additional charges or in case you do any damage," he said.

Authorization holds are very common in the travel industry, which was the case in many of Humphrey's transactions.

The authorization hold policy is usually detailed in the fine print, the part we often skip over. The News On 6 found it on the Hertz website. The News On 6 also called the Hilton, and they use holds no matter if you use a debit or credit card.

"I don't know what it is that's triggering this to happen, but all I know is it's frustrating," Humphrey said.

According to Pam Girardo with Capital One's corporate office, not everyone necessarily sees these holds. They do not show up on your statement, for example. Girardo went on to explain that Capital One is now in the process of updating its system to denote holds versus actual charges because "holds are not actual charges and do not accrue interest." Girardo admitted the holds do impact your available credit temporarily.

The best advice is to check out the policy for the place where you are shopping and check with your bank about your credit line.

More Like This

September 29th, 2024

September 17th, 2024

Top Headlines

December 11th, 2024

December 11th, 2024

December 11th, 2024

December 11th, 2024