Financial Advice: HerPlanning Founder Shares Ways To Develop Generational Wealth

Kristin Afelumo with HerPlanning joined News On 6 at Noon on Wednesday with Autumn Bracey to discuss ways families can develop generational wealth.Wednesday, August 23rd 2023, 1:39 pm

TULSA, Okla. -

Kristin Afelumo with HerPlanning joined News On 6 at Noon on Wednesday with Autumn Bracey to discuss ways families can develop generational wealth.

You can learn more about HerPlanning HERE.

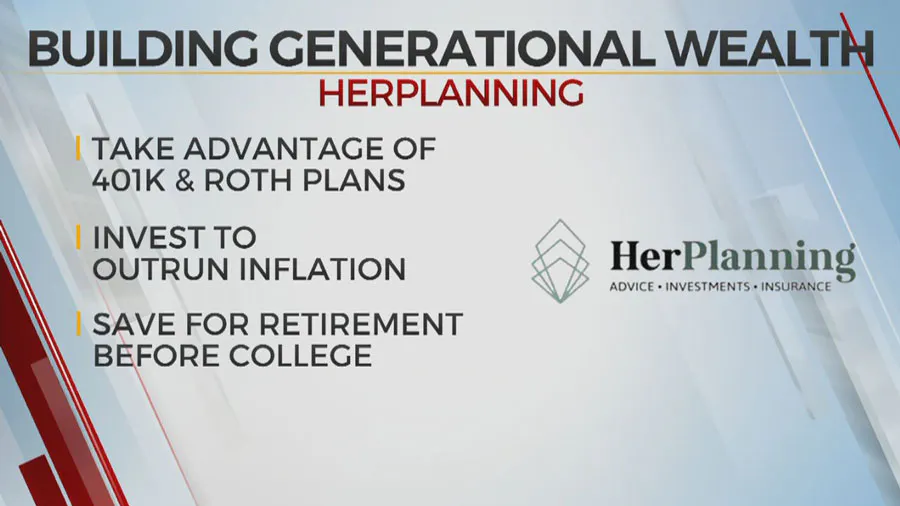

Why are 401k's and Roth plans important?

Use them! They have tax advantages and can provide tax-free growth, Afelumo said. They also have tax-deferrals which means you get a deduction when you divert income into these accounts. It's best to start these accounts right when you begin a new job and if you're only putting in 1 percent income, it won't be as impactful on your paycheck.

Should high inflation impact my investments?

Keep in mind that on average, the stock market returns about 7 percent, meaning your money doubles every 10 years if you just invest it for growth and leave it alone, Afelumo said.

Most people don't spend everything in these accounts while they're living, so they can be passed along to the next generation as long as the person is listed as a beneficiary.

Should I save for retirement or college?

Save for retirement before college, says Afelumo. Put you investments in your 401k. You don't want to spend your kids' inheritance on retirement and there are other ways to pay for college like loans and scholarships.

More Like This

December 2nd, 2024

November 26th, 2024

November 26th, 2024

Top Headlines

December 11th, 2024

December 11th, 2024

December 11th, 2024

December 11th, 2024