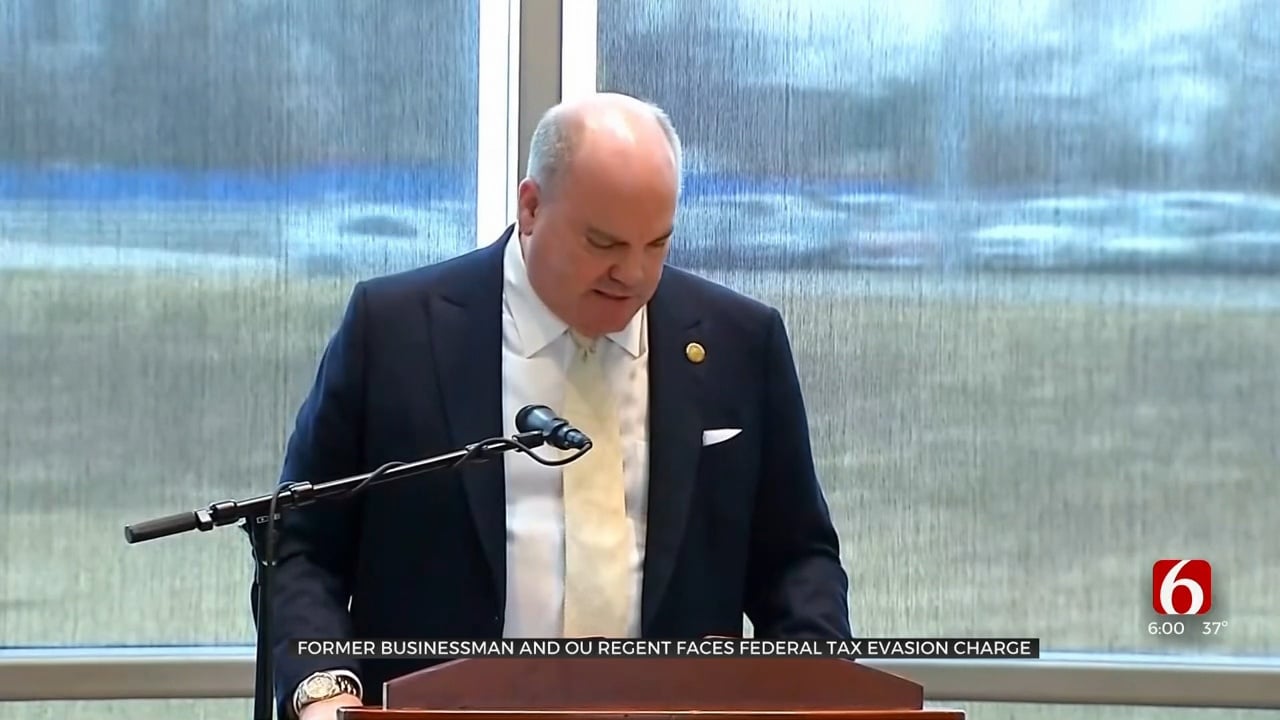

Former Claremore Businessman Faces Federal Tax Evasion Charge

A former Claremore businessman faces a federal tax evasion charge. Phil Albert is also accused of embezzling millions from his former company.Wednesday, January 25th 2023, 6:12 pm

CLAREMORE, Okla. -

A former Claremore businessman faces a federal tax evasion charge. Phil Albert is also accused of embezzling millions from his former company.

The embezzlement case dates back to 2019 and has not seen any action in court in more than a year.

This new tax evasion charge was just filed this week in US District court for the Northern District of Oklahoma and is Albert's latest public problem with money.

Federal prosecutors said over the course of seven years, Albert did not properly report his income for the calendar year of 2016.

Court records said Albert turned in a false and fraudulent 1040 tax return to the IRS.

In an emailed statement, Albert's attorney, Paul DeMuro said, "Phil has been a leader in Oklahoma civic and philanthropic causes for many years. He looks forward to working with the government to resolve this case as expeditiously as possible."

In a separate, civil lawsuit, Albert is being sued by the company he co-founded.

Pelco, a steel pole manufacturer in Claremore, claims Albert spent more than $7 million without authorization between 2010 and 2019.

Pelco claims as much as $315,000 went to politicians and charities.

The lawsuit said Pelco fired Albert immediately after the theft was discovered.

Court records show Albert is representing himself in that case, and nothing has moved forward in court since 2021. However, it is unclear why.

Albert served on the OU Board of Regents for five years before resigning last January. He is scheduled to go before a federal judge in Tulsa on Thursday for the tax evasion charge.

More Like This

January 25th, 2023

March 28th, 2023

March 3rd, 2023

February 27th, 2023

Top Headlines

December 13th, 2024

December 13th, 2024

December 13th, 2024

December 13th, 2024